House prices are still rising, but can we afford to buy? Photo: Chris Roe.

As Aussies, we tend to be pretty private about our pay packets, but as the housing affordability crisis deepens, we decided to ask – how much do you need to earn to buy a home in regional NSW in 2023?

One of my favourite bits of home loan trivia is that the medieval origins of the word “mortgage” literally translate to “death contract”.

Originating in the Norman French dialect that bled into English after 1066, mortgage is a mashup of “mort” (death) and “gage” which means promise.

While Aussie banks are unlikely to update the language, signing a “contract of death” would certainly cause homebuyers to think twice!

My wife and I bought our first home this year and I was surprised at how little we could actually afford, despite having a solid deposit and two incomes.

Sydney’s insane property market left us behind decades ago (our suburban rental sold for an eye-watering $3.4 million soon after we moved) and a tree change seemed like the best option.

We are blessed to have found a home for our family of five and to live and work in a great community in Wagga, but things are still pretty tight.

Since signing our “contract of death” in January, we have received a steady flow of emails from our bank informing us of our increasing debt as interest rates continue to rise.

At this point of course Boomers are rolling their eyes and preparing to launch into a back-in-my-day argument about sky-high interest rates and point out that millennials are squandering their income on Netflix, avocados and espresso.

No doubt things were rough in the 80s when interest rates hit 16 per cent, but the average home loan at that time was around twice the annual income whereas today it is more than six times.

The median house price in regional NSW soared during COVID-19, jumping by $200,000 in less than two years.

We know there’s a housing shortage across the country, but with a high cost of living and stagnating wages, one wonders who would be able to buy the homes, even if we can catch up with demand.

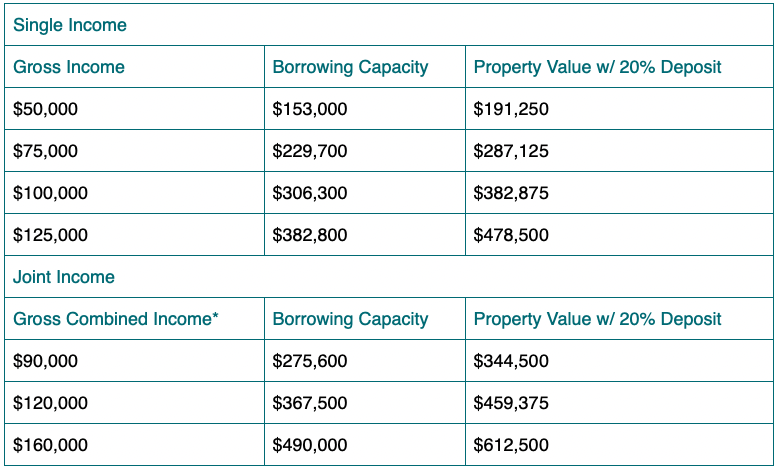

Finance comparison platform Canstar published research last month exploring how much homebuyers need to earn to avoid suffering mortgage stress, defined as paying more than 30 per cent of gross household income.

They laid out three criteria, including the size of your deposit, how much a lender will give you and how much you can realistically afford when expenses, debts and liabilities are weighed against your income.

The calculations were then based on a 20 per cent deposit and loan repayments of less than 30 per cent of pre-tax income.

According to 2021 census data, the median weekly household income in Wagga is $1564, which translates to $81,328 per year.

The median house price for a 3-bedroom home in Wagga in 2023 is $660,000.

If we loosely compare this to Canstar’s research it suggests that a household earning $90,000 a year would be able to get a mortgage of around $275,600 to purchase a property valued at under $344,500.

To afford the median house price for a 3-bedroom dwelling, a household would need a combined income of more than $160,000.

If you are looking for a loan on a single income, to afford the median 2-bedroom house price of $489,000, you will need a salary somewhere north of $125,000.

(These numbers are of course predicated on the homebuyer’s ability to save a 20 per cent deposit in the face of ever-rising rents – but that’s another story for another day!)

Numbers estimated by Canstar based on specific criteria in May 2023. Photo: Canstar.

Where does it all end? Will increased housing supply and a flood of new ‘affordable homes’ help to tip the balance? One tends to think it’s unlikely, given the vested interests in a ‘robust’ housing market.

But while the prices go up, the house itself hasn’t really changed. Nor has the basic human need for a place to live.

At the risk of getting overly philosophical, as long as we view housing in terms of ‘investments’ and ‘assets’ and rising ‘dollar values’ rather than recognising the intrinsic value of what a house represents, we will never fix housing affordability.

“It’s not a house it’s a home,” declared blue-collar Aussie dad Darryl Kerrigan (Michael Caton) in The Castle, prompting QC Laurie Hammill (Bud Tingwell) to paraphrase in court.

“A home is not bricks and mortar, but love and fond memories. You can’t pay for it and you’re just shortchanging people if you try.”