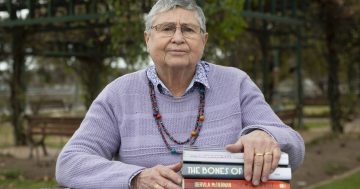

Junee residents protest the CBA bank closure last Thursday. It looks likes their cries have been heard. Photo: Struan Timms Photography.

The Commonwealth Bank of Australia (CBA) has agreed to pause the closure of all regional branches for the duration of 2023 while a Senate Committee conducts an inquiry into the impact the shutting down of financial institutions is having on regional communities.

Junee Shire Council has led a community campaign against the CBA’s earlier decision, announced late last year, which would have meant residents faced an hour-plus round trip to Wagga to make big transactions or access loan services.

Today (Monday 13 February), the grassroots campaign celebrated a significant win.

“Following consideration of a request from the Senate Committee, CBA will not close any regional branches while the Inquiry is underway in 2023,” a CBA spokesperson said in a statement.

“As an additional sign of good faith, while the inquiry is underway in 2023, CBA will postpone the closure of two branches already announced.

“We continue to welcome constructive engagement with government, industry and communities – an approach demonstrated by our recent work with all members of the Regional Banking Taskforce.

“CBA looks forward to assisting the inquiry, and continuing to engage with our customers and communities, as we collectively respond to the digitisation of the economy and banking services.”

Region has confirmed the announced closure of Junee’s last bank, scheduled for March 2023, now won’t go ahead until at least next year.

On Friday, Region reported that Junee Shire Council general manager James Davis had urged the Commonwealth Bank to postpone all regional bank closures until a new Senate inquiry on the issue, announced last week, handed down its findings in December 2023.

“We are pleased to hear the announcement that the Commonwealth Bank will not be closing its last branch in Junee while this inquiry takes place,” Mr Davis said.

“[This decision] gives weight to the community campaign [against the closure].”

On Thursday 9 February, more than 100 people protested outside the Junee CBA branch.

A symbol of the campaign was 88-year-old Maisie Robinson, who pulled out the passbook she opened at the Junee branch in 1943.

Ms Robinson was facing the prospect of having to acquire a bank card for the first time in her life and to learn how to use online banking.

Maisie Robinson shows the passbook from the account she opened in Junee in 1943. Photo: Struan Timms Photography.

“It’s almost an impossible situation for her. Why should she need to feel anxious?” Mr Davis said.

CBA had said Junee residents could use the post office for their banking after it closed its last branch in the town, but this facility does not accept passbooks, offer loan services or provide for the large transactions that businesses like the Junee Licorice and Chocolate Factory need.

Mr Davis said while Monday’s CBA statement was a significant win, there was a lot more work that needed to be done.

“We will now be seeking the re-instatement of opening hours to five days, which was the case before the closure was announced,” Mr Davis said.

CBA had originally planned to shut its last Junee branch late last year but, following an initial community campaign, agreed to delay the closure until March 2023.

However, while the bank remains open, it no longer maintains full-time hours – it is only open three half-day days a week.

Rural bank closures have been a hot topic throughout Australia lately, with researcher Dale Webster estimating two-thirds of all regional bank branches have shut since 1975, a trend that accelerated this past year.

Victorian Nationals MP Darren Chester recently spoke out about Westpac’s announcement that it would close its last branch in the town of Sale by May.

“Forget about crooks wearing balaclavas – the real bank robbers are the executives making decisions in city boardrooms. These corporate bank robbers are robbing country towns of jobs, they’re robbing vulnerable people of services and they’re robbing regional Australia of growth opportunities,” he told parliament in a speech on 6 February.

Further details on the new Senate inquiry into regional bank closures can be found here. The committee is due to hand down its report and recommendations on 1 December 2023.